Each product search entered into a search engine creates one or more electronic auctions where advertisers bid for available ad slots on the Shopping ad “carousel being” being served to the prospective buyer.

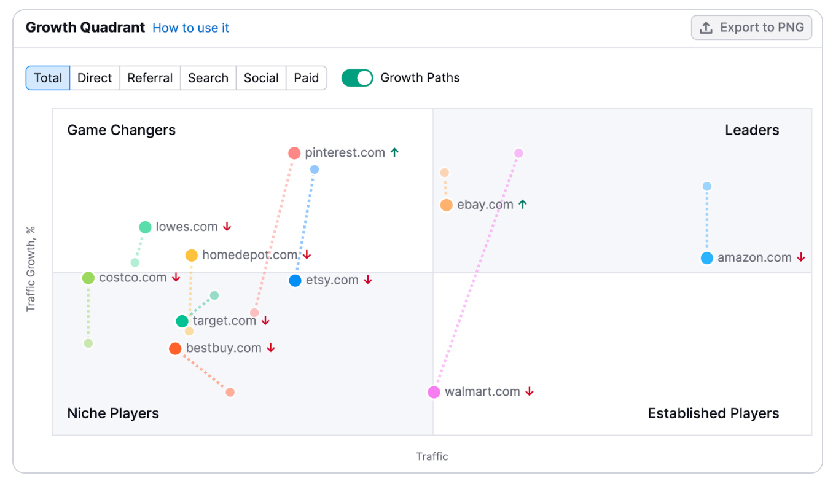

We identify direct and indirect competitors, familiarizing ourselves with their products, services, and positioning in the market. We look at the advertising history, ad copy, ad spend, and market positioning of the most significant online competition.

While spidering competitor websites we can extract entire product feeds to examine the feed attribute details. During this process we gain a level of understanding which is uniquely useful in structuring and configuring Shopping campaigns.

What we’re driving for is both a qualitative and quantitative understanding of the competitive digital advertising environment. We want need to understand how your product is positioned against competitors; your unique selling position, and most effective features, benefits, and characteristics.

This informs our strategy in developing your campaign and allows us to ballpark a daily ad spend recommendation. We use tools to identify average click costs and conversion rates in the sector, vertical, and geo target the campaign will run in, along with other key performance indicators (KPI’s).

Search ad campaigns operate in a competitive environment online which is often different from the actual direct business competition. Often the same keywords and audience targeting are shared by different vertical markets, services, or products. This “keyword overlap” phenomena strongly impacts many ad auctions. So the online competitive environment can be quite different than the offline competitive environment. In PPC, whoever shows up at your auctions is in effect, a competitor because they are putting pressure on bids.

This step sets the stage our keyword research process.